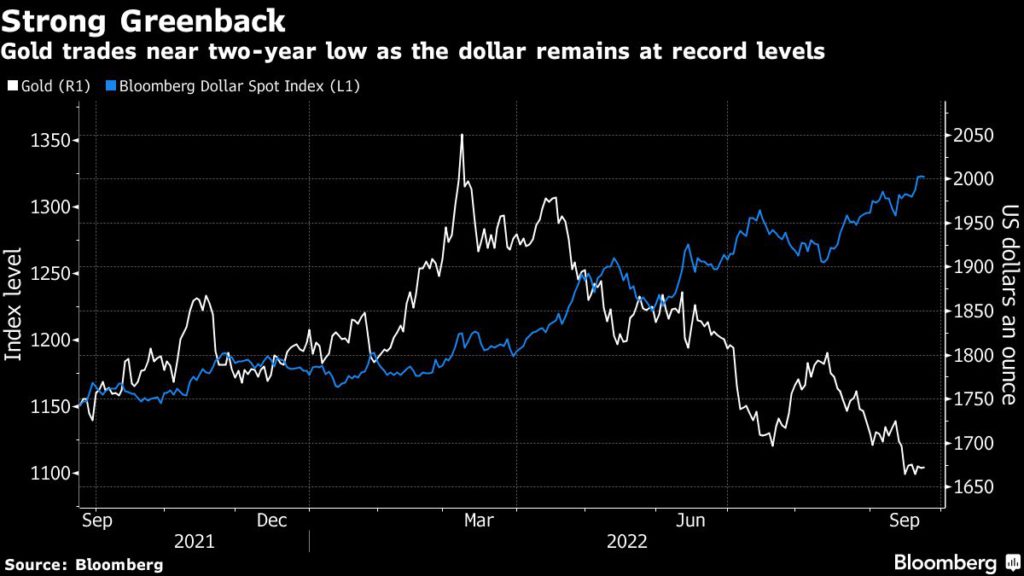

Gold price down 2% as precious metals make way for surging US dollar

[Click here for an interactive chart of gold prices]

Behind the decline was a surging dollar index, which hit a multi-decade peak on Monday, becoming the preferred safe haven asset for investors at the expense of gold.

“There’s no safety trade anywhere, so gold will be liquidated … There’s a massive correction going on, and when volatility gets that high, you can’t find safety or comfort anywhere,” Phillip Streible, chief market strategist at Blue Line Futures in Chicago, said in a Reuters report.

Hotter-than-expected US CPI data on Friday led to traders now betting on a total of 175 basis point (bps) in rate hikes by September, with some seeing a chance for a 75 bps move this week.

Gold hit a one-month trough post the inflation data, but later rebounded as economic concerns took centre stage. That volatility has extended into this week, with bullion beating a sharp retreat from a one-month high hit during the Asian session.

The quick unwinding in gold highlights the current tug-of-war between its pricing drivers, with firm inflation being countered by bets for aggressive policy responses, JP Morgan said in a note.

A bullish gold outlook would require more signs that economic growth is cracking under the strain of higher inflation, the note added.

Meanwhile, other precious metals also suffered sharp declines, with palladium recording the biggest loss at 7.0% to $1,801 per ounce.

(With files from Reuters)