Post Noront takeover, Wyloo gets to work on Ring of Fire assets

And most importantly, perhaps, it promised movement on a project that has been stalled by a lack of infrastructure and by disagreement among First Nations on development, invoking Forrest’s experience as founder of major iron ore producer Fortescue Metals Group (ASX: FMG).

“Seventeen years ago, people told me Fortescue’s deposits would never be mined because there was no infrastructure to access our projects. We proved those critics totally wrong and we want to do the same in the Ring of Fire,“ said Andrew Forrest in a press release last year during the takeover battle for Noront.

After emerging victorious from the “fierce battle” with BHP and closing the acquisition of Noront in April, Wyloo is wasting no time getting to work.

Exploration potential

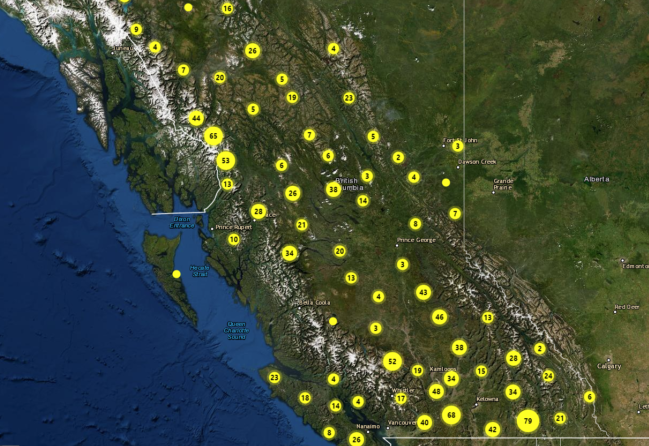

In early June, the private Australian company reopened the Esker exploration camp in Ontario’s James Bay Lowlands for the first time in three years. The company then began a 3,000-metre drilling program at Blue Jay — the first of 76 targets it intends to drill in the Ring of Fire.

The acquisition includes five existing high-grade orebodies: Eagles nest (nickel-copper-PGMs), McFaulds (copper-zinc) and the Blackbird, Big Daddy and Black Thor chromite deposits.

However, Wyloo CEO Luca Giacovazzi says that although those deposits have potential to be mined, the main attraction of Noront’s Ring of Fire claims was the exploration potential.

“We love the existing mines, but we thought, wow, these guys have just scratched the surface of the exploration potential here,” said Giacovazzi in an exclusive interview at the Prospectors and Developers Association of Canada conference in mid-June.

“Exploration-wise, the Ring of Fire must be one of the most exciting packages of ultramafic rocks in a mining friendly jurisdiction.”

This post has been syndicated from a third-party source. View the original article here.