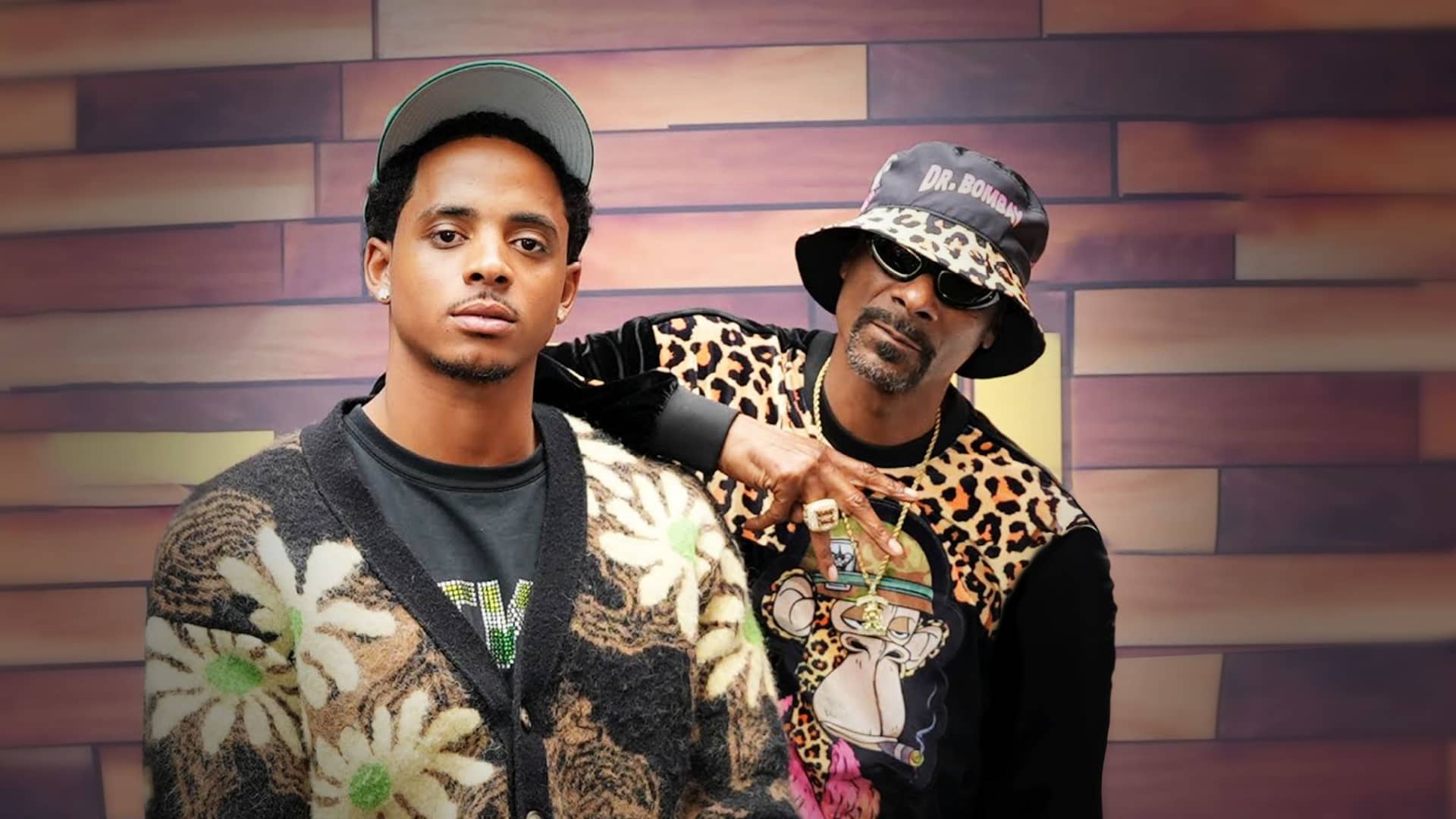

Snoop Dogg on the current crypto winter and future of NFTs: ‘Every great industry has a downfall’

Perhaps the most prominent celebrity figure in the Web3 zeitgeist is Snoop Dogg, but for Snoop being an early adopter is nothing new.

In 2014, the rap icon was part of a $50 million investment into Reddit, which valued the company at around $500 million at the time. Today, the platform is worth $15 billion, according to PitchBook data. He’s also known for private investments into fintech companies like Robinhood, Klarna and MoonPay, and for investments in the cannabis space. In 2015, just one year before weed was approved to be legalized for recreational use in California, Snoop co-founded Los Angeles-based Casa Verde Capital — a VC fund that has more than doubled in size.

Of course, these days, anyone following him on Twitter knows that his attention has been consumed by anything and everything that has to do with Web3 — especially NFTs.

NFTs are unique digital assets, like artwork and sports trading cards, that are verified and stored using blockchain technology, but critics see them as overhyped and potentially harmful to the environment given the energy-intensive nature of cryptocurrencies. Many NFTs are built on the network behind ethereum, the second-biggest token.

Earlier this year, Snoop announced his plans to turn Death Row Records, a record label that he acquired from Blackstone-controlled MNRK Music Group, into an “NFT label.” Shortly after, one of his first NFT collections called “Journey of the Dogg” saw one token sell at auction for over $100,000. In September, Snoop revealed that he had an alias known as anonymous NFT art collector Cozomo de’ Medici, who had a digital collection worth over $17 million.

“I know [NFTs] have a great opportunity to be big in music, because sooner or later the labels are going to have to come on in,” Snoop told CNBC in an exclusive interview at last week’s NFT.NYC conference in New York City. “They’re going to have to come on home and sit at the table and understand that catalogs and things they hold onto are better served on the blockchain than sitting in the catalog collecting cobwebs.”

“And it’s not just labels,” his son, Cordell Broadus, a.k.a. Champ Medici, added. “It’s movie studios, it’s tech companies, it’s beverage companies … everybody’s rushing to Web3 and they see how big Dogg is in the space.”

Playing in Snoop’s Sandbox

Snoop has also spent the past year digging into the metaverse.

He recently partnered with gaming platform The Sandbox to sell “The Snoopverse Early Access Pass” which gives buyers access to experiences in The Snoopverse, his own branded world within The Sandbox platform. There were 5,000 early access passes minted using blockchain technology at the time of its launch. Each one currently costs a bit more than $600, and according to The Sandbox, there are currently 1,114 owners, which means that the sale has generated nearly $700,000 — a significant haircut from the $1.7 million it had generated earlier in the year. The recent downturn has been dubbed by many as the latest “crypto winter,” referring to a period when crypto prices fall and stay low for an extended period of time.

“I feel like every great industry has a downfall,” Snoop said. “There’s been a depression in every industry you can look at … alcohol, tobacco, clothing, food; every industry you can imagine.”

Some crypto industry leaders expect a period of “creative destruction” wiping out many players. Mark Cuban, who has become a big investor in blockchain-based technologies, recently compared the crypto crash to “the lull that the internet went through” during the dotcom bubble and tweeted that there are too many imitators out there. Snoop Dogg has a similar view.

“This [crypto winter] weeded out all the people who weren’t supposed to be in the space and who were abusing the opportunities that were there” he said. “Now it’s going to bring on great business, and moving forward, when the market comes back, there will only be great things to pick and choose from,” he added.

Snoop’s latest project is a collaboration with Food Fighters Universe (FFU), which claims to be the world’s first NFT restaurant group. His ice cream brand, Dr. Bombay’s Sweet Exploration, is set to open in Los Angeles under the FFU umbrella. The brand was inspired by an NFT that Snoop owns from the prominent Bored Ape Yacht Club collection, many of which skyrocketed in price and became the most recognizable NFTs online, but have seen steep declines in price during the recent digital currencies selloff.

ApeCoin, a token launched by Bored Ape creators Yuga Labs, has seen a steep increase since Snoop appeared on-stage at NFT.NYC on Thursday night to debut a new single with Eminem, featuring the Bored Ape branding in the rap duo’s corresponding music video.

As is the case with many NFT collections, FFU token holders have exclusive access to various festivals, benefits and perks via their ownership of one of the 10,000 NFTs in the collection. Additionally, all physical restaurant locations that fall under the FFU umbrella will accept cryptocurrency as a form of payment.

FFU co-founder Kevin Seo told CNBC it will launch “within this year” and will be a dessert retail experience built around the Snoop Dogg community. Separately, Champ Medici’s Bored Taco will continue to be a food truck and a ghost kitchen brand.

“We’re excited to continue to create ways to utilize crypto as payment and showcase utility through our Food Fighters Universe NFTs, with access to events and free food with our NFT holders,” Seo said.

“Web3 and NFTs? This is just the beginning,” Champ told CNBC. “People are going to look back at this five years from now and see how innovative Food Fighters Universe was and how we were pushing the boundaries very early when other people didn’t see the vision.”

While prominent investors continue to be believers in the long-term potential of digital assets, including Cathie Wood of Ark Invest, there are plenty of skeptics.

Speaking at a TechCrunch talk on climate change last week, Bill Gates described the crypto and NFT phenomenon as something that’s “100% based on greater fool theory,” referring to the idea that overvalued assets will go up in price when there are enough investors willing to pay more for them.

The billionaire Microsoft co-founder joked that “expensive digital images of monkeys” would “improve the world immensely,” referring to the much-hyped Bored Apes.

Meanwhile, crypto investors continue to grapple with aggressive interest rate hikes from the Federal Reserve and a worsening liquidity crunch that has pushed major players into financial difficulty and given a megaphone to some of the biggest NFT skeptics. The broader space is also still reeling from the fallout of the $60 billion collapse of two major tokens last month.

This post has been syndicated from a third-party source. View the original article here.