Canadaâs Top Ten precious metals juniors

NovaGold Resources (TSX: NG; NYSE-AM: NG) holds a 50% stake in the huge Donlin Creek gold deposit, 450 km northwest of Anchorage, Alaska, along with 50% partner Barrick Gold (TSX: ABX; NYSE: GOLD).

Last December, the partners announced they are working to update the feasibility study project before the end of 2022. It will be the first update since a 2009 feasibility study pegged capital costs at US$4.5 billion.

The project, one of the highest-grade known open-pit gold deposits in the world, currently has a measured and indicated resource of 541 million tonnes grading 2.24 grams gold per tonne for 39 million oz. of contained gold. Inferred resources stand at 92 million tonnes grading 2.02 grams gold per tonne for 6 million ounces.

The resources are contained in the ACMA and Lewis pits, which occupy 3 km of an 8-km-long mineralized belt.

The partners have budgeted a total of $60 million for work on Donlin Creek this year — the largest project budget in more than a decade. The work includes engineering activities for use in the upcoming study and 34,000 metres of in-pit and below-pit drilling, to be incorporated into updated geologic modelling and interpretation. The budget will also support field work, permitting work for the Alaska Dam Safety Certifications, and environmental studies.

This year’s program builds on a 79-hole, 24,264-metre drill campaign conducted last year that yielded multiple high-grade gold intercepts and which has better defined controls and mineralization.

Highlights from drill results released in February included: 19 metres of 18.23 grams gold per tonne starting at 144.5 metres depth, including 14.3 metres of 23.49 g/t gold in hole DC21-2017; and 77.6 metres grading 3.51 grams gold starting at 262.6 metres, including 7.9 metres of 12.39 grams gold in hole DC21-1994.

#2 Seabridge Gold

Market Cap: C$1.3 billion ($1bn)

Seabridge Gold (TSX: SEA; NYSE: SEA) has a 100% interest in the giant KSM deposit in B.C.

In late June, Seabridge released an updated prefeasibility study for KSM that brought the East Mitchell deposit, acquired from Pretium Resources in 2020, into the mine plan. The study built on an updated resource for KSM released in April that included East Mitchell (previously called Snowfield).

The prefeasibility study forecasts initial capital costs at $6.4 billion – up from $5 billion projected in a 2016 prefeasibility, primarily due to inflation. The open pit development would have a 33-year mine life, with an after-tax net present value (at 5% discount) of $7.9 billion (up from $1.5 billion in the previous study), with the internal rate of return doubling to 16.1% from 8%.

The study projects KSM would generate a total after-tax net cash flow of $23.9 billion, up from $10 billion previously, with a payback period of 3.7 years (down from 6.8 years).

Mill throughput has increased to 195,000 tonnes per day from 130,000 tonnes, with a projected annual production increase of 90% for gold, 22% for copper, 36% for silver and 363% for molybdenum. The strip ratio has been reduced by 23% to approximately 1:1 and previous plans for block cave mining have been eliminated. The project would also lower greenhouse gas emissions by incorporating an electric haul fleet.

Other elements of the project are also falling into place: in March 2022, the company announced a C$225-million financing deal with Sprott and Ontario Teachers Pension Plan to support the project until construction decision. That same month, Seabridge signed an agreement with BC Hydro to supply green power for KSM.

Seabridge’s portfolio also includes several other gold deposits: the Courageous Lake, Iskut, Snowfield and 3 Aces in Canada, and Snowstorm in the United States.

#3 Osisko Mining

Market Cap: C$1.3 billion ($1bn)

Osisko Mining (TSX: OSK) is advancing its high-grade Windfall Lake gold project, located on the Abitibi greenstone belt, 200 km northeast of Val-d’Or, Que. The company expects to release a resource update followed by a feasibility study on the project, in the Eeyou Istchee James Bay region of Quebec, in the fourth quarter.

A preliminary economic assessment released in April 2021 outlined a C$544 million, two-ramp underground mine that would produce an average of 238,000 gold oz. a year over an 18-year life. The 3,100 tonne-per-day operation would produce an average of 300,000 oz. gold annually in its first seven years at all-in sustaining costs of $610 per oz. The PEA pegged the after-tax net present value at $1.5 billion, using a 5% discount rate and $1,500 per oz. gold, and its internal rate of return at 39.3%. Payback would be achieved in 2.2 years.

Measured and indicated resources at Windfall currently stand at 3.2 million oz. gold in 9.5 million tonnes grading 10.5 grams gold per tonne. Inferred resources add 3.6 million oz. in 13 million tonnes grading 8.6 grams gold.

The resource is hosted in four zones — Lynx, Underdog, Main and Triple 8. The company also discovered a new zone, Golden Bear, located about 1 km away from Windfall, last June.

Work this year is focused on detailed engineering for the mill and other project components as part of the feasibility study, as well as infill and exploration drilling from surface and underground. A 5,000-tonne bulk sample is also under way, with another planned for later this year.

The company confirmed in February that it would proceed with development of the project on its own, after plans to joint venture with Australia’s Northern Star Resources (ASX: NST) fell through.

Osisko controls 2,600 sq. km in the Urban Barry area and nearby Quévillon area of Quebec.

#4 New Found Gold

Market Cap: C$1.1 billion ($850m)

New Found Gold (TSXV: NFG; US-OTC: NFGFF) stays in the Top Ten this year, but slides to the No. 5 spot from No. 2. The junior continues to advance its 100%-owned Queensway gold project, 15 km west of Gander, N.L. The 1,500-sq.-km project is located near the Trans-Canada Highway and the company is operating 12 drill rigs in a 400,000-metre drill program. New Found plans to increase its drill number to 14 as it targets more than 20 km of prospective strike along the regional-scale Appleton and JBP fault zones.

About 48% of the program has been completed.

Gander Lake divides the project into Queensway North and Queensway South.

At Queensway North, the company has since June 2021 discovered two new high-grade gold zones: Golden Joint and the newest Tuesday zone, as announced on June 8. The Keats and Lotto zones at Queensway North were discovered in 2019 and 2020, respectively.

Drilling at the Tuesday zone intersected 2 metres of 89.5 grams gold per tonne from 55 metres below surface.

Other drill highlights this year include 14.2 metres of 69.2 grams gold per tonne starting at 300 metres at Golden Joint (announced on Mar. 24); and a near-surface intercept of 2.2 metres grading 275 grams gold from a vertical depth of 22 metres (announced on May 4).

And at Lotto, the main high-grade gold vein has been extended to a vertical depth of 225 metres with an intercept of 2.2 metres of 24.25 grams gold over a strike length of 200 metres, according to drill results in late March.

A maiden drill program is planned for Queensway South for this year.

#5 Rupert Resources

Market Cap: $976.8 million ($752.1m)

Entering the Top Ten for the first time, the Toronto-headquartered junior explorer Rupert Resources (TSXV: RUP) continues to advance exploration at its 100%-owned Rupert Lapland gold project in northern Finland, which it acquired in 2016.

The 595-sq.-km project is located within the Central Lapland Greenstone Belt, which has two significant gold mines: Agnico Eagle’s (TSX: AEM; NYSE: AEM)’s Kittilä mine — the largest gold mine in Europe which produced over 200,000 oz. of gold in 2020 — and Pahtavaara, which produced almost 450,000 oz. of gold over 16 years.

Pahtavaara is east of Rupert’s main Ikkari deposit, which has a combined open pit and underground inferred resource of 49 million tonnes at 2.5 grams gold per tonne for 4 million ounces.

More than 45,000 metres of drilling have been completed at Ikkari since its initial resource last September and it plans to conduct another 85,000 metres of drilling this year.

In its latest results, announced in early June, the company reported a near-surface high grade zone to the east of Ikkari returned 59 metres of 8 grams gold per tonne at a vertical depth of 116 metres.

And at central Ikkari, drilling revealed 24 metres of 6.3 grams gold from a depth of 206 metres.

At Pahtavaara, where work on a mineral resource estimate is under way, 93 holes for a total of 6,561.5 metres have been drilled since 2021 as part of an ongoing 10,000-metre program.

In March, Agnico Eagle exercised warrants to acquire 11.5 million common shares in Rupert, with Agnico now holding 28.6 common shares or 15.1% of the company’s issued ordinary shares.

#6 Artemis Gold

Market Cap: $919.6 million ($708m)

Artemis Gold (TSXV: ARTG) continues to move toward production at its 100%-owned Blackwater gold project in central British Columbia.

According to a feasibility study released last September, Blackwater is expected to produce 339,000 oz. gold per year at an all-in sustaining cash cost of C$850 per oz. during its 22-year life. Progress of the open pit project, located 446 km northeast of Vancouver, moved forward during the spring, when Artemis awarded Sedgman Canada with a C$312 million contract for the engineering, procurement, construction and commissioning (EPC) of the Blackwater processing plant. It is due to be executed by June 30, this year, with construction starting in the fall and the first gold pour expected in the first half of 2024.

Blackwater has proven and probable reserves of 334.3 million tonnes grading 0.75 gram gold per tonne and 5.8 grams silver per tonne for 8 million oz. of gold and 62.2 million oz. of silver.

The initial capital cost of the phased project is estimated at C$645 million. Throughput in the first phase of production is planned at 6.6 million tonnes per year, with an output of 321,000 oz. gold per year in the first five years. Throughput will rise to 12.6 million tonnes per year in the second phase, with 381,000 oz. gold produced per year in years six to 10 at an expansion capital cost of C$347 million. In years 11 to 17, throughput would rise to 20 million tonnes annually for production of 438,000 oz. gold per year following a capital investment of C$374 million. Mining operations are expected to end in the seventeenth year and stockpiled ore is to be processed in the plant in years 18 to 22. In that final phase, 176,000 oz. gold will be produced.

At a 5% discount rate, Blackwater’s after-tax net present value would come to C$2.2 billion, based on a long-term gold price of $1,600 per oz., and its after-tax internal rate is estimated at 32%.

#7 Skeena Resources

Market Cap: $663 million ($510m)

Making its way into the Top Ten for the first time this year, Vancouver-headquartered Skeena Resources (TSX: SKE: US-OTC: SKREF) is focused on revitalizing its 100%-owned Eskay Creek gold-silver mine in northwestern British Columbia.

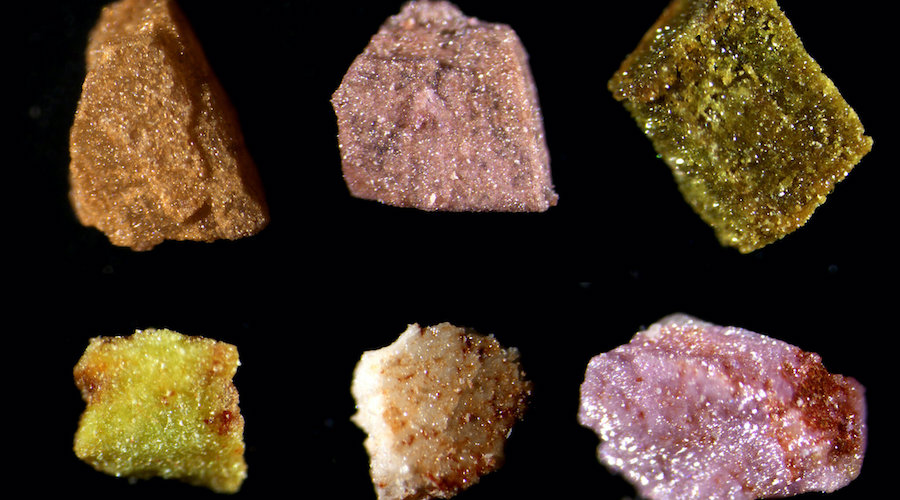

Located in the Golden Triangle and about 82 km northwest of the town of Stewart, Eskay Creek was the highest-grade gold mine in the world when it was in production from 1994 to 2008. The mine produced 3.3 million oz. of gold and 160 million oz. of silver at average grades of 45 grams gold per tonne and 2,224 grams silver.

Highlights from regional and near-mine exploration programs released in March included highgrade gold mineralization discovered 60 metres west of 21A Zone pit-constrained resources at Eskay in a 34-metre interval averaging 8.78 grams gold per tonne and 13 grams silver per tonne (8.95 grams gold-equivalent per tonne).

Earlier in the year, the company released highlights of the 23 Zone, discovered last year, including 7.4 metres of 3 grams gold and 4 grams silver.

Those discoveries came just months after Skeena released a preliminary prefeasibility study for Eskay, which outlined proven and probable reserves of 26.4 million tonnes with a diluted grade of 3.37 grams gold per tonne and 94 grams silver.

The mine is expected to produce more than 2.4 million oz. of gold and 70.9 million oz. of silver in total over a life of 9.8 years. The study estimated preproduction capital costs of C$488 million, with sustaining capital of C$47 million and reclamation costs of C$92 million. The after-tax net present value (at a 5% discount) was pegged at $1.4 billion and the internal rate of return at 56%.

Skeena is set to continue with its 60,000-metre drilling program this year.

#8 Sabina Gold & Silver

Market Cap: C$597.7 million ($460.2m)

Sabina Gold & Silver (TSX: SBB; US-OTC: SGSVF) continues to advance its 100%-owned Back River gold project in Nunavut toward production.

Located about 520 km northeast of Yellowknife, N.W.T, Back River comprises six properties in an 80-km-long belt including Goose, George, Boulder, Boot, Del and Bath. Most work is being done at Goose and George.

The company announced a comprehensive $520 million financing package for the mine in February.

A February 2021 feasibility study outlined a C$610 million open pit and underground operation producing an average of 223,000 oz. of gold per year over 15 years at Back River, with about 287,000 oz. of gold produced annually for the first five years.

The project’s after-tax net present value is estimated at C$1.1 billion, based on a 5% discount rate and US$1,600 per oz. gold. The internal rate of return was estimated at 27.7%, and the payback period at 2.3 years.

In early June, results from its 3,500-metre spring drilling program at the V2 Zone included 45.1 metres grading 12.59 grams gold per tonne starting from 123.6 metres and 20.4 metres grading 12.64 grams gold starting from 146.4 metres.

Earlier in the year, Sabina said it could expand the capacity for its mill at Goose to 4,000 tonnes per day from the outset of development, rather than starting with a 3,000 tonne per day mill and later expanding it, because of increased tailings storage capacity at the Echo pit. That combined with optimized equipment selection and detailed engineering reduced the cost of the mill expansion to C$10 million from C$17 million.

Market Cap: C$573.7 million ($441.7m)

Bolivia-focused New Pacific Metals (TSX: NUAG; NYSE-AM: NEWP) is new to the Precious Metals top 10 this year. The company has three silver projects in the South American country: Silver Sand, located 35 km northeast of the Cerro Rico mine near Potosi; Carangas, 180 km southwest of the city of Oruro; and Silverstrike, 140 km southwest of La Paz.

New Pacific is planning to update the resource for Silver Sand in September, followed by a preliminary economic assessment by the end of the year. A 2020 resource for the project outlined a measured and indicated resource of 35.4 million tonnes grading 137 grams silver per tonne for 35.6 million ounces. Inferred resources add 9.8 million tonnes at 112 grams silver for 35.6 million oz.

Mineralization at Silver Sand — one of the earliest mineral discoveries in Bolivia in the 1500s — starts at or near surface and is amenable to open pit mining and heap leaching.

Recent highlights from drilling in May include infill hole DSS646001, which intersected 60.5 metres grading 236 grams per tonne silver starting at 82.1 metres, including 6.5 metres grading 1,423 grams silver.

At the Carangas silver-gold project, a 40,000-metre drill program for 2022 is under way with four drill rigs onsite. Drilling in 2021 of 13,000 metres in 35 holes outlined a 1,000-metre by 700-metre silver zone discovery overlying a broad gold zone in rhyolitic bodies.

Drill highlights released in May include 595.7 metres grading 1.25 grams gold per tonne and 7 grams silver, starting from 161.6 metres. This broad gold zone occurs beneath a silver horizon of 41.6 metres grading 41 grams silver, 1% lead and 1.72% zinc starting from 62.4 metres. The hole was terminated in mineralization at a depth of 757.3 metres due to difficult drilling conditions and capacity of the drill rig.

Several targets at Silverstrike, which has seen historical mining and was drilled by Rio Tinto in the mid-1990s, will also be drilled this year for Silver Sand and Carangas-type discoveries.

#10 Discovery Silver

Market Cap: C$459.7 million ($353.9m)

Discovery Silver (TSXV: DSV; US-OTC: DSVSF) is focused on its flagship 100%-owned Cordero open-pit project in the northern part of the Central Mexican Silver Belt in Chihuahua state.

Discovery Silver, which changed its name from Discovery Metals in April 2021, acquired Cordero in August 2019, and describes the project as a Tier 1 silver asset and “one of the world’s largest undeveloped silver resources.”

A preliminary economic assessment of Cordero in November 2021 outlined a 16-year mine life with average annual production of 26 million oz. silver-equivalent and average life-of-mine all-in sustaining costs of $12.35 per ounce.

The early stage study estimated initial development capex of $368 million and a payback of 2 years using base case metal prices of $22 per oz. silver, $1,600 per oz. gold, $1.00 per lb. lead and $1.20 per lb. zinc.

Cordero would have an after-tax net present value (5% discount rate) of $1.2 billion and after-tax internal rate of return of 38%.

Silver represents more than 60% of the net smelter return in the first five years of mine life and more than 50% of the NSR over the life-of-mine. Concentrate from the mine will be trucked to Guaymas port in Sonora state and the project benefits from flat topography and is near local power lines and roads.

In May, the company reported results from 19 drill holes from its Phase 2 program, with highlights of 337 grams silver-equivalent per tonne over 34 metres starting from 622 metres, about 70 metres below the PEA pit and 606 grams silver-equivalent over 18.1 metres from 230 metres downhole, immediately below the PEA pit.

In June, veteran mining executive Tony Makuch, a member of the company’s board of directors, was appointed interim chief executive officer.

This post has been syndicated from a third-party source. View the original article here.