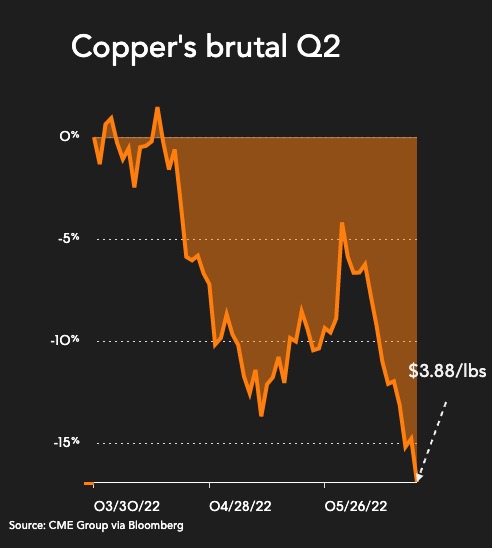

Copper price down on manufacturing slowdown in China

[Click here for an interactive chart of copper prices]

“Globally, the macro side of things is dampening sentiment. Chinese economic data is weak and confidence is low,” said Geordie Wilkes, an analyst at trading firm Sucden Financial.

“Rate cuts in China are having a negative effect because it confirms fears that China’s economy isn’t performing well.”

Also weighing on industrial metals are aggressive increases in interest rates by the US Federal Reserve.

Meanwhile, power problems in Europe and China are expected to reduce metal production and support the prices of energy-intensive aluminum and zinc.

“Copper uses a lot less power; it is more resilient,” Sucden’s Wilkes said, adding that current copper prices are too high. “The next target for us is $7,800.”

(With files from Reuters)

This post has been syndicated from a third-party source. View the original article here.