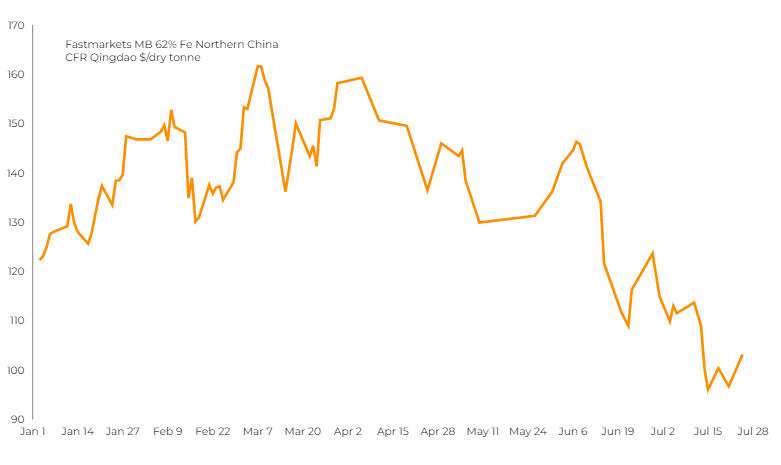

Aluminum price lowest since April 2021 on strong dollar and demand outlook

Benchmark aluminum on the London Metal Exchange (LME) was down 0.6% at $2,247.50 a tonne by 1023 GMT after touching its lowest since April 2021 at $2,243.

The price of the metal has lost 20% this year.

[Click here for interactive aluminum price chart]

“Supply of aluminum and other metals is tight and inventories are low, but the market is more focused on weakening demand and the rising dollar,” said independent analyst Robin Bhar.

“If the dollar’s going higher, metals are going to struggle,” he said, predicting that aluminum prices would end the year around current levels.

Reflecting weakening demand, global aluminum producers have offered Japanese buyers lower premiums for primary metal shipments.

Meanwhile, two more European producers announced cuts as the local metals industry reiterated it’s facing an “existential threat.”

Speira GmbH will cut production at its smelter in Germany by 50% until further notice, while Europe’s largest aluminum smelter, Aluminium Dunkerque Industries France, said on Tuesday it will reduce production by 22% by the end of the month.

The curtailments add to the extreme toll that the energy crisis is having on Europe’s metals industry, which is one of the biggest industrial consumers of power and gas.

A group representing the region’s biggest producers wrote to European Union politicians warning that the energy crisis could cause “permanent deindustrialization” in the bloc, unless a package of support measures is implemented.

The region’s aluminum and zinc production capacity has already fallen by about 50% over the past year, even before the latest cuts, and aluminum output has dropped to the lowest levels since the 1970s.

(With files from Reuters and Bloomberg)

This post has been syndicated from a third-party source. View the original article here.