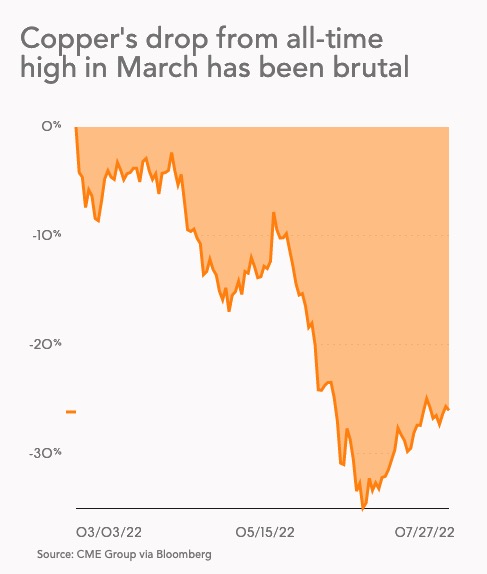

Copper price up on lower-than-expected inflation in China

[Click here for an interactive chart of copper prices]

The most-traded October copper contract on the Shanghai Futures Exchange advanced 3.2% to 62,900 yuan ($9,069.41) a tonne.

The dollar took a breather from its surging rally, making greenback-priced metals cheaper to holders of other currencies.

China’s consumer prices rose at a slower-than-expected pace in August amid heatwaves and covid-19 flare-ups, while producer inflation hit an 18-month low.

The orange metal prices are also supported by a tight immediate supply. The premium of cash copper on the LME over the three-month contract ended at $108.50 a tonne on Thursday, its highest since November 2021.

Copper demand in China has improved since last month, CRU analyst He Tianyu said, adding that consumption of the metal is expected to be stronger in the fourth quarter.

(With files from Reuters)

This post has been syndicated from a third-party source. View the original article here.