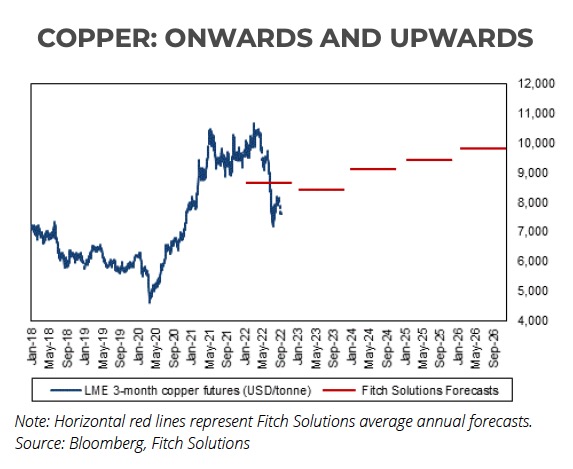

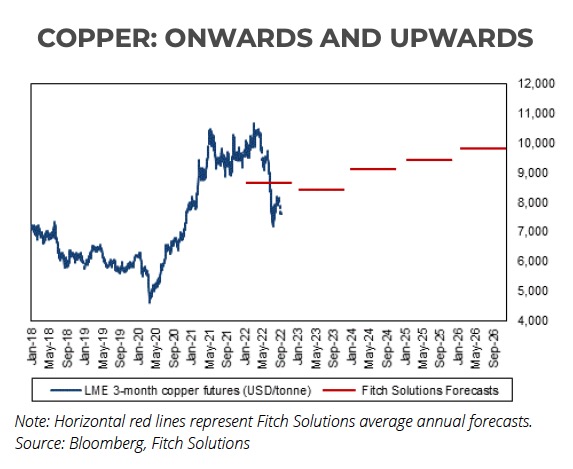

Fitch: Copper price to regain March peaks in 2027

A new report by Fitch Solutions cuts the research firm’s 2023 price forecasts for next year by double digits to $8,400 down from a previous projection of an average of $9,580 for the year.

Fitch expects a small surplus on the copper market for this year, but from 2023 expects growing deficits peaking at some 9 million tonnes by the end of the decade as demand accelerates “mainly driven by consumption related to the green transition.”

Fitch says “a significant pipeline of new projects [which] will bring additional copper to the market – particularly in Chile, Peru, Australia and Canada” and also expects “a number of the key supply issues in Latin America to ease in the coming years”:

“From around 2026, however, these improvements in supply will be increasingly outpaced by demand growth from the global transition to a green economy.”

Fitch sees steady improvement to copper prices over the next five years with the metal returning to its March peaks above $10,000 in 2027 and $11,500 in 2031 as “a long term structural deficit emerges.“

Fitch points to a number of risk factors that could darken this rosy long term forecast however including further strengthening of the dollar if US monetary policy tightening accelerates, further regulation by the Chinese government to reduce commodity prices, a more stable resolution to some of the industrial tensions in Latin America and faster-than-expected uptake in copper recycling.

This post has been syndicated from a third-party source. View the original article here.