Investing abroad could be the solution to Americaâs clean energy future

In total, 22 US states have set the goal to have 100% carbon-free electricity before 2050. A massive and rapid deployment of renewable energy is also central to Europe’s drive to end its dependency on Russian fossil fuels.

However, even as president Biden declared this week ‘Detroit is back’ and announced $900 million to build EV charging stations across America, the question remains how quickly the transition to renewable energy can be made.

In his latest book “Volt Rush: The Winners and Losers in the Race to Go Green,” Benchmark Mineral Intelligence Executive Editor Henry Sanderson discusses the global supply chain of materials and mining needed for the electric push.

Sanderson elaborates in an interview with MINING.COM:

MINING.COM: Is it feasible for us to transition to clean energy over the next decades?

We have to. You look at the extreme weather, this year was the hottest in Europe. China is dealing with record heat waves. So we have to move to clean energy. Countries like China are victims of climate change that also produce many of the solutions. So I think there’s a huge incentive to scale up clean energy and the costs.

The Russian invasion of Ukraine highlights how our reliance on fossil fuels is so problematic.

It may be difficult if we don’t want to rely on China at all. Does the US and Europe want to do it on their own without China? That’s going to be more difficult in the timeframe, by 2030, but with China, I think it’s possible.

MINING.COM: Is there enough metal to replace oil?

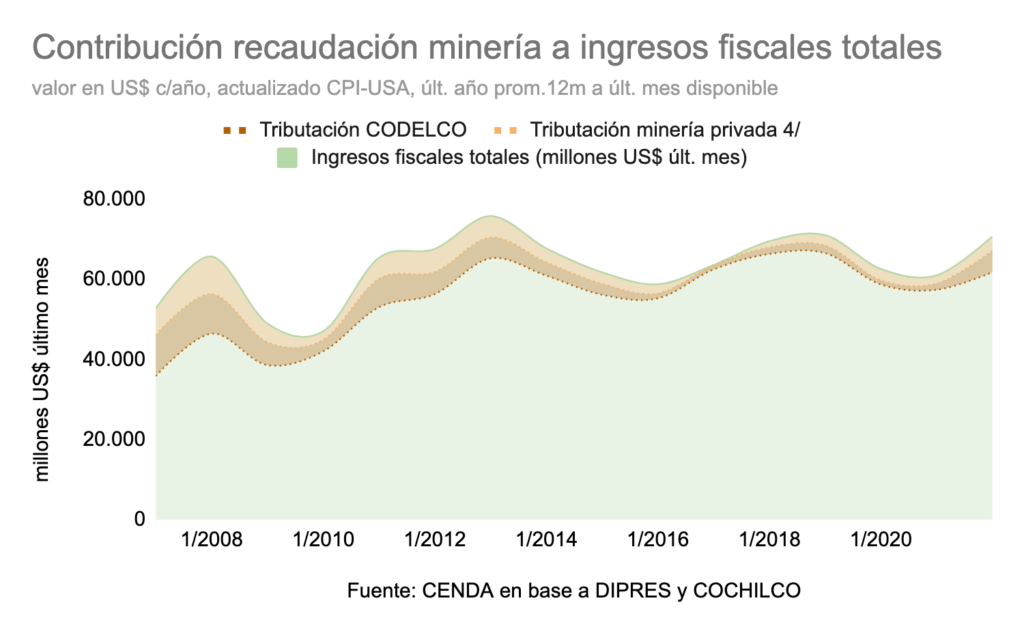

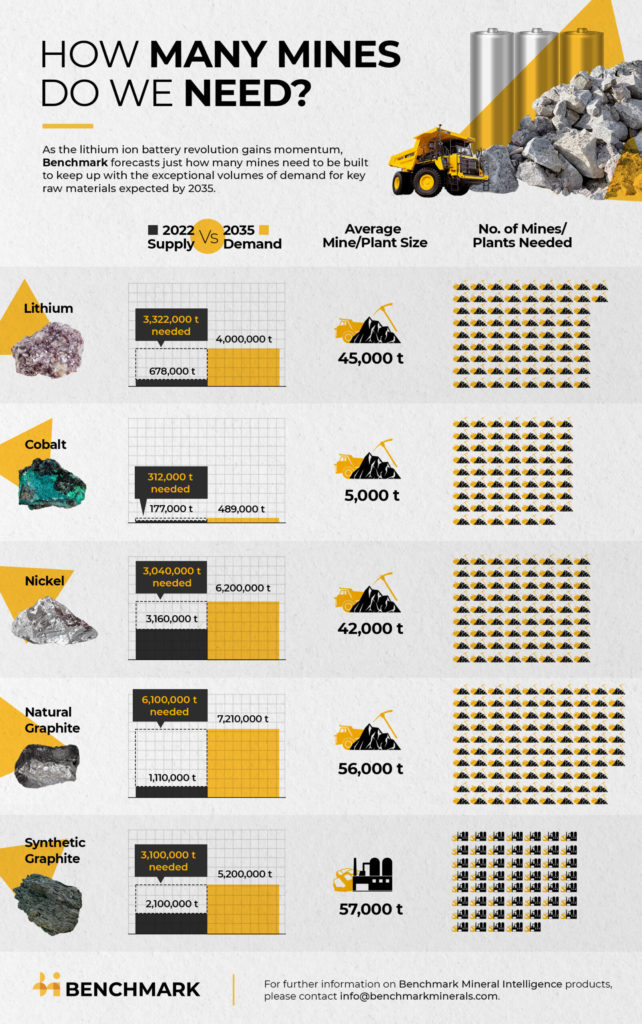

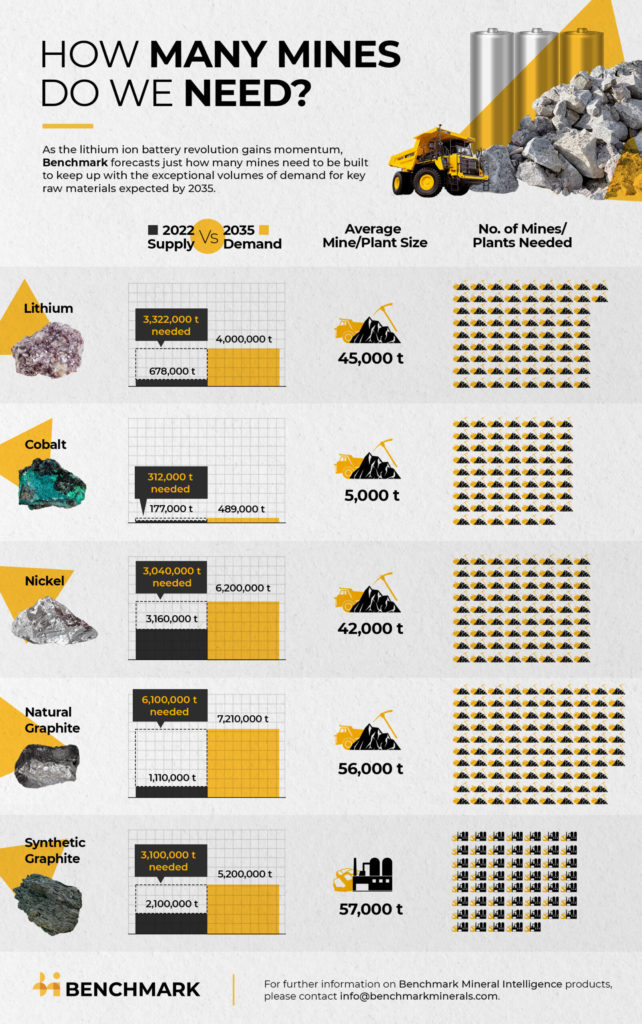

I think few people are aware that to solve climate change, we need speed and scale. Scale is critical. So when you’re talking about the scale of batteries for EVs, for energy storage, there are enough raw materials on the earth. The problem we have is that this energy transition is quite a policy-driven one.

It has to be fast to meet the climate goals. We’ve left it so late. So when you have this exponential demand increase this decade and the next, it’s gonna be hard for mines to keep up. And also what sort of social environmental cost are we willing to bear to get all these mines into production? Where are we willing to mine?

MINING.COM: Mining in America is not a really popular topic. How do you see Biden’s Administration’s push to clean energy so far?

The Inflation Reduction Act is important because it’s a signal and action. The critical mineral requirements are very strict and difficult to meet. If mines can get approved in the US, then I think there’ll be policy support for it but it is difficult.

So what I see happening is probably more Canada. There’ll be more mine development in Australia, in these free trade agreement countries. What you need to do is build up the processing in the US or North America and Canada. So you know that you can divert the raw materials from Australia to North America, not to China. It’s just an industrial facility, it’s not rocket science.

If the US and Europe want to completely develop their own supply chains by scratch, that’s going to be very challenging

I think probably the best thing is to help these mineral-rich countries with mining backgrounds to develop their mines. That’s probably easier than building in the US. Why aren’t we helping the DRC? There’s graphite in Mozambique, for example, and these are all places that will suffer from climate change but can benefit from these minerals.

MINING.COM: What do you say to those worried about the CO2 emissions in the green metals supply chain?

When it comes to metals, we have this perception that maybe is going to be colossal, a gigantic effort to put that supply chain to work.

The fossil fuel infrastructure is just so colossal. Just take a look at Europe and the energy crisis. The fossil fuel infrastructure is so key to our economies, and so massive. The battery minerals pale in comparison to fossil fuels.

The point in my book is saying, if you are building this battery supply chain from scratch, let’s try to avoid some of the old problems. Every additional tonne of CO2 emitted is an environmental cost. So let’s try and keep it as low CO2, as least environmentally destructive as possible.

MINING.COM: What are the biggest challenges right now for the energy transition?

The biggest challenge is geopolitical. If the US and Europe want to completely develop their own supply chains by scratch, that’s going to be very challenging. Given the urgency of this energy transition, we probably all need to work together a bit more.

The second challenge is the poorer countries. What are we going to do to help them? What we can do to help them mine sustainably and responsibly?

There are a couple of risks. First is that tensions escalate to a point where China considers using its leverage. We’ve seen China boycott foreign companies and foreign goods. The second risk is that a lot of these Chinese companies are very innovative, especially battery companies. If there is a shortage of batteries or raw materials, how much will they get priority over Western companies?

MINING.COM: When it comes to EVs, how do we move from premium models like Teslas to a more mass market?

China’s quite a lesson in this space because the best-selling EV there is this tiny Hongguan Mini, which uses a tiny battery. Consumer choice will play a big part in determining raw material demand. If we are gonna just replace big SUVs with electric SUVs or pickup trucks with electric pickup trucks, then we need lots of metals. Are we willing to use this transition as an opportunity to change some of our motor transport? Can we accept smaller cars in the city? If you look at average driving distances, they’ve been coming down in the Western world.

MINING.COM: Stanford professor Mark Jacobson estimated that in a clean energy world, the total mining burden would drop 80% but yet there’s this great fear about expanding mining for green metals. Why?

I think probably the answer is just for a Tesla or other big automaker to really invest in mining, given its sort of stamp of approval, to say we need this mine. But I think some companies may be afraid of certain projects in the US, where there are still issues with indigenous peoples or communities.

MINING.COM: So when you see a hundred percent EV? Let’s keep it to cars.

Well, let’s take China, it’s already over 25% of total vehicle sales. I’d say maybe by 2050 we could get there, but definitely earlier in China.

(By Bruno Venditti and Frik Els)

This post has been syndicated from a third-party source. View the original article here.