SoftBank CEO Masayoshi Son seeking ‘strategic alliance’ between chipmaker Arm and Samsung

SoftBank CEO Masayoshi Son said he is seeking a “strategic alliance” between chipmaker Arm, which is owned by the Japanese giant, and South Korean tech conglomerate Samsung.

“I intend to visit Korea. I’m looking forward to visiting Korea for the first time in three years. I’d like to talk with Samsung about a strategic alliance with Arm,” Son said in a statement.

related investing news

There were no further details provided by SoftBank on what a strategic alliance would entail, but it could mark a big shift in strategy for Son and his vision for Arm.

Samsung declined to comment when contacted by CNBC.

SoftBank acquired U.K.-headquartered Arm, one of the world’s most important chipmakers, in 2016 and Son has since said it is key for the company’s long-term vision as more and more devices become internet connected.

Since then, SoftBank tried to sell arm to chipmaker Nvidia but the deal fell through in February.

Son is now pushing toward a public listing for Arm, preferably in New York. But the U.K. government wants Arm to list in London. SoftBank wants to keep a majority stake in Arm following an initial public offering.

Samsung’s Vice Chairman Lee Jae-yong said Wednesday he plans to meet Son when he visits South Korea, according to a report by The Korea Herald.

Lee said that Son “might come up with such a proposal” regarding Arm but admitted that he has “no idea what that is,” according to statements reported by The Korea Herald.

Arm’s chip architecture is behind many of the world’s smartphone processors including those from Apple and Samsung.

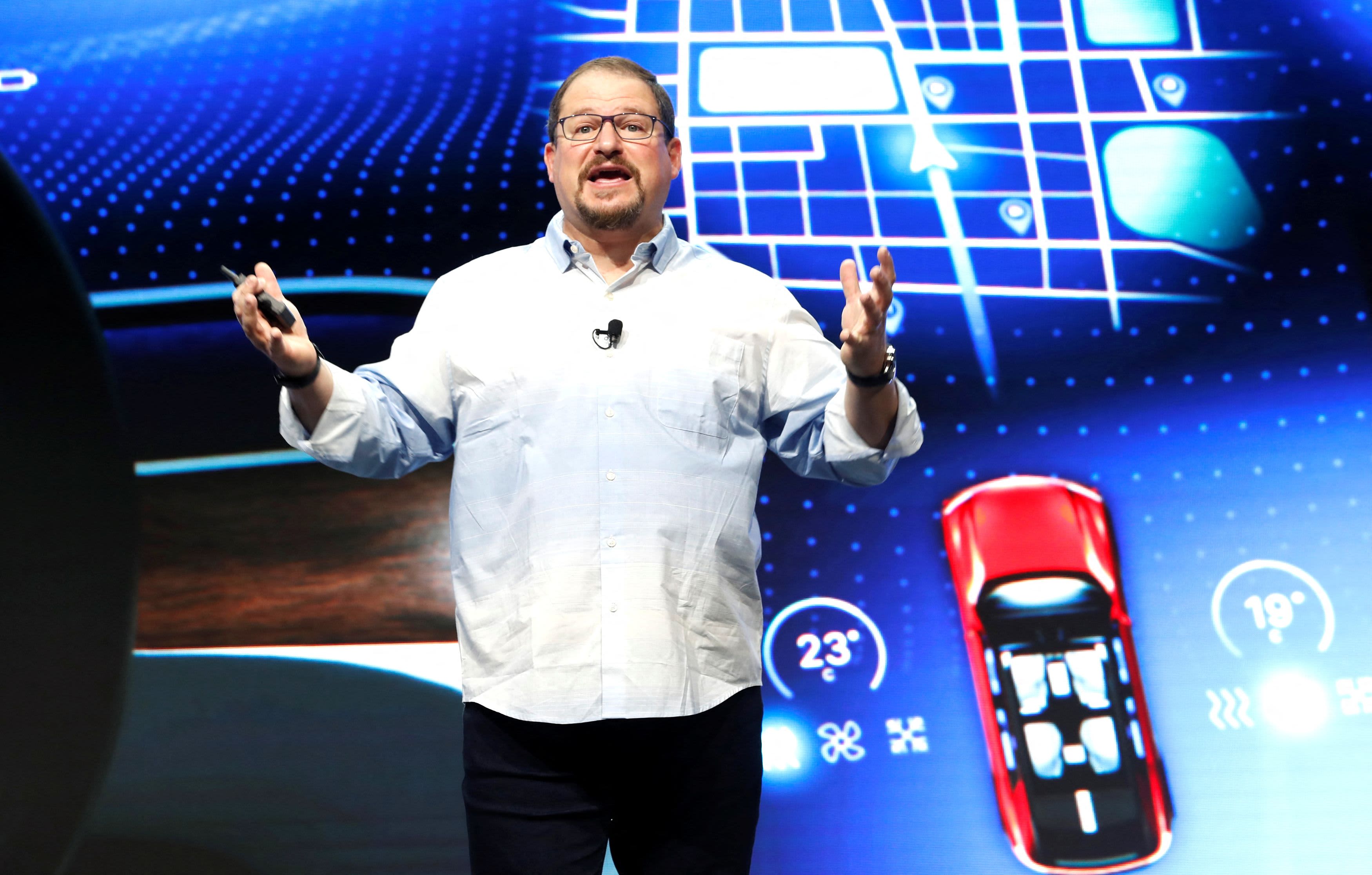

Other companies have also been touted as being interested in buying a stake in Arm. Cristiano Amon, CEO of U.S. chipmaker Qualcomm, said the company is “an interested party in investing” in Arm earlier this year.

There has also been speculation around a consortium model with several companies being part of a group that invests in Arm.

SoftBank has been under pressure to monetize Arm after its flagship tech investment business, the Vision Fund, posted record losses in its last fiscal year. SoftBank sold the remainder of its entire stake in U.S. ride hailing company Uber in the second quarter and trimmed its holdings in Chinese e-commerce giant Alibaba, to raise cash.

This post has been syndicated from a third-party source. View the original article here.