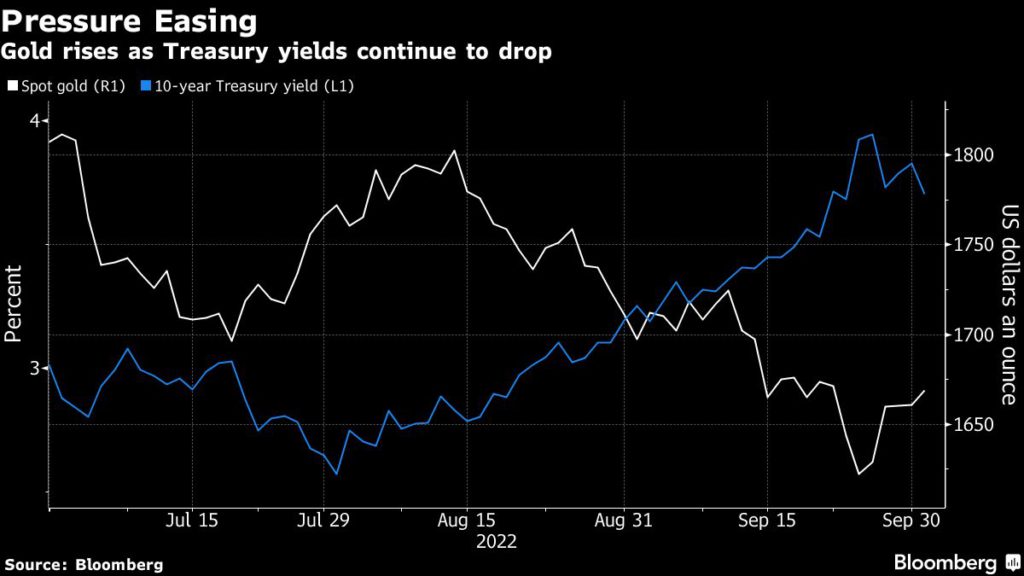

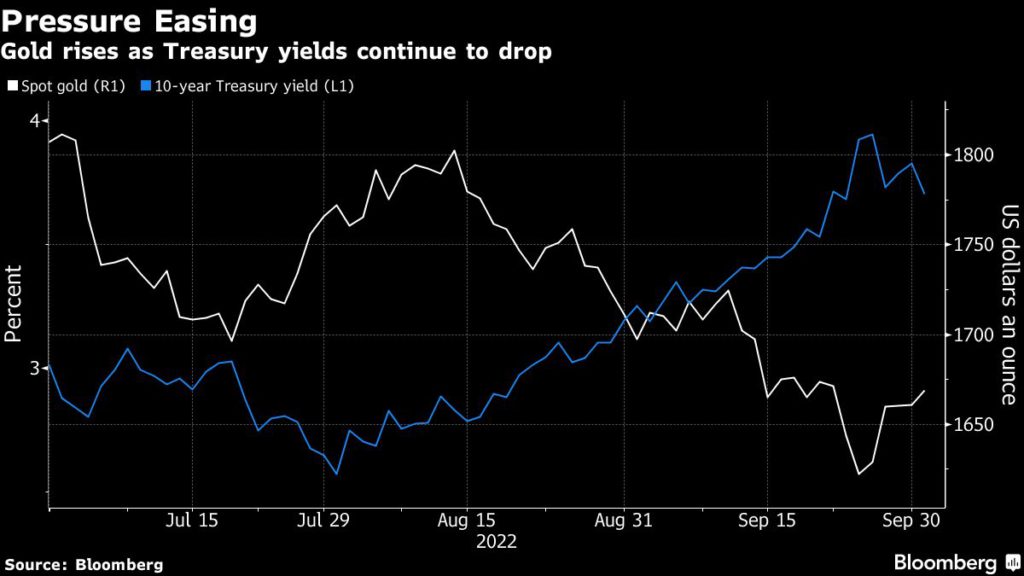

Gold price extends rally as Treasury yields retreat continues

[Click here for an interactive chart of gold prices]

Bullion has now extended its first weekly gain in three, as lower bond rates boosted the appeal of the non-interest-bearing asset. Investors remained on edge about the impact of aggressive interest rate hikes after a slew of Federal Reserve officials last week re-emphasized their resolve to fight inflation.

Traders will now look to US jobs data due on Friday for more clues on the future path of central bank monetary policy. That means bullion could be in for more volatility, with strong numbers potentially spurring further gains in bond yields that would be harmful for gold.

“I think the Chancellor of the Exchequer forced to reverse on tax cuts has taken UK out of ‘crisis’ mode so GBP higher, USD lower, yields lower, stocks higher and other assets like precious higher as well,” Tai Wong, a senior trader at Heraeus Precious Metals in New York, told Bloomberg.

Short-covering triggered the metal to break through technical levels, which in turn sparked more short-covering, Wong added.

“Gold prices remain in a strengthening downtrend,” warned TD Securities commodity strategists led by Bart Melek. “The risk of capitulation remains prevalent for the yellow metal moving into October, with strong data continuing to point to a more aggressive Fed rate path ahead.”

Investors continue to abandon gold at pace, with hedge funds trading on the Comex hiking their short bets for the seventh week running as of Tuesday. Exchange-traded funds have seen outflows for 16 straight weeks, according to an initial tally by Bloomberg. The metal has dropped by almost 9% so far this year.

There are still a plethora of risks for financial markets, including concerns about Credit Suisse Group AG, helping support prices. The cost of insuring the bank’s debt against default rose to a record Monday, though it remains far from distressed levels.

“Gold holds above Friday’s low at $1,660, supported by geopolitical and financial risks and a cooling of the recent dollar and yield surge,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

“The price needs to break the critical resistance zone into $1,678-$1,690 that is the departure point for this latest bear-market move.”

(With files from Bloomberg)

This post has been syndicated from a third-party source. View the original article here.