Is Your Bank Financing Fossil Fuel Companies? This App Lets You Find Out.

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Around the froyo machine in CleanTechnica’s posh rooftop solarium and yoga studio, several staff members were talking this week about how to stop doing business with banks that finance fossil fuel projects and put their money into financial institutions that are funding clean energy investments instead. It’s a frequently asked question, but there have been few good answers — until now.

We Don’t Have Time is an organization whose mission is to wake us all from our reverie in which we assume that someone, somewhere will find a solution to global overheating and save us from having to do much of anything to avoid a sixth extinction event. You might think it wouldn’t take much to get that message across, since the headlines everyday are about droughts, floods, wildfires, and rising sea levels. All we have to do is look out our window to know things are changing and not in a good way.

Nevertheless, as Bill McKibben says, “capitalism — which regularly acts homicidally — is acting truly suicidally. Having been warned for years now, it resists every effort to rein in its excesses. As Exxon’s CEO helpfully explained earlier this year, it’s not that you couldn’t make good money from renewable energy, you just couldn’t make ‘above average returns’ because sunshine is free. So instead we’ll tank the world, and with it the world economy.”

McKibben said that it’s not just the megabanks doing it. Regional banks are getting in on the act as well, spurred on by the anti-ESG policies created by several red States. BOK Financial in Oklahoma recently become one of the world’s 30 busiest dealmakers in fossil fuels. Marisol Salazar, a senior vice president, says the bank is now seeing “much more opportunities” in the fossil fuel industry. “We’re not just picking up customers. We’re also picking up talent, we’re picking up engineers, we’re picking up investment bankers, we’re picking up experienced relationship managers.”

The Carbon Bankroll 2.0 report released recently made it clear that for many companies — Apple, Amazon, and Microsoft, among others — the bulk of their carbon emissions are related to the cash they keep on deposit in banks that lend it out to build more fossil fuel infrastructure. That report says, “If the largest banks and asset managers in the U.S. were a country, they would be the third-largest emitting country in the world, behind only China and the US.”

Move The Money!

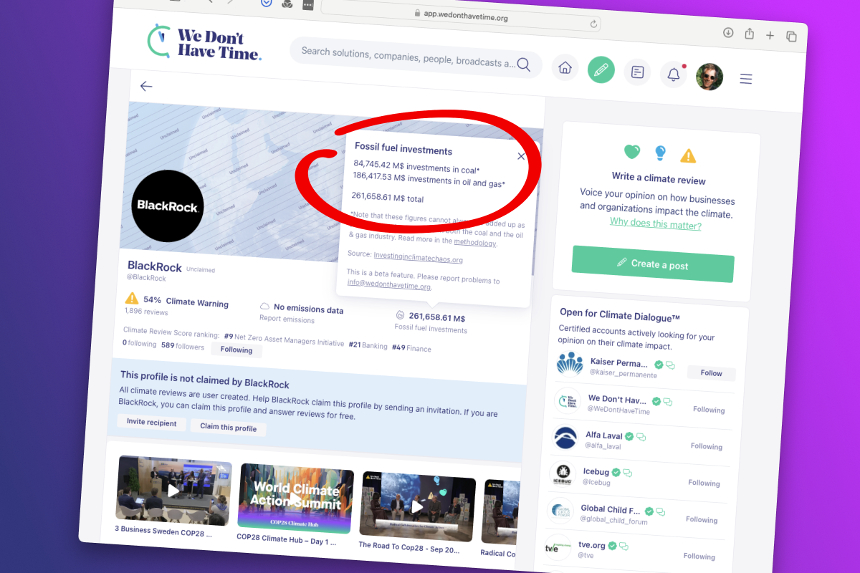

We Don’t Have Time has created an app that lets people like you and me find out what our bank is doing with our money. If it turns out it is not acting in accordance with our wishes, we can find other banks that do and move our money over there. In the world of digital finance, it’s easy to do online. Visit the WDHT website to download the app.

To get stakeholders (that is — you and me) to start moving their money at scale, they need easy access to information about how much their banks, pension providers, or other institutional investors are actually investing in fossil fuels. The new app allows anyone to search for their bank or pension provider and instantly see their fossil fuel investments. The app currently has access to data for more than 7,000 companies. About half of that number is now searchable on the WDHT platform, with more coming soon.

“When searching for this data on We Don’t Have Time, the great thing is that you will also get information on new investment policies that haven’t yet affected the data,” WDHT says. “If you, for instance, search for Danske Bank, you will see that it has invested $1,236 million in coal, oil, and gas. But you will also see that Danske Bank has recently taken significant steps to reduce its investments in fossil fuels. So what are you waiting for? Start searching for your own bank or pension provider. If you find that they invest in fossil fuels, contact them and ask about their divestment plans. If you’re unsatisfied with the response, use your consumer power and Move the Money!”

Will it make a difference if one of us moves our money around? No, of course not. But if a few thousand or a few hundred thousand people do, then yes, it will make a difference. We never had an easy way of finding out who was doing what with our money before, but now we do with the WDHT app.

Nick Nutall On Fossil Fuel Funding

On Earth Day, Nick Nuttall, the UN Spokesperson for the Paris Climate Agreement, spoke at an event sponsored by the Nordic Pension Fund co-hosted by We Don’t Have Time. Here is a synopsis of of his remarks:

“Let us remind ourselves that we need to halve global emissions by 2030 to have a 50/50 chance of hitting net zero mid-century and keeping an average global temperature rise no higher than 1.5C. Without finance shifting, we won’t make it. $1.8 trillion is currently invested in clean energy needs, but the International Energy Agency estimates $4.5 trillion a year will be needed by 2030. But what if we don’t invest in decarbonization across all sectors in all parts of the globe?

“In other words, we sit back, go play golf and have permanent wild parties watching the sun set. Setting aside the suffering and misery that uncontrolled climate change would cause, the best economics indicate not investing in climate action would also be economic shot in the foot. The Climate Policy Initiative report says, ‘The longer we delay meeting total climate investment needs, the higher the costs will be both to mitigate global temperature rise and to deal with impacts.’

“What we need is private sector finance to step up big time, not for charitable reasons, but because it is in everyone’s self-interest. Let the temperature soar and many will find their business models under stress and perhaps in danger of collapse. Unfortunately, there appears to be a collective schizophrenia here among far too many banks, equity funds and others able to make a difference, not least when it comes to funding or not funding the very substances that are causing much of the problem– the fossil fuel companies.

“The main funders, according to the Banking on Chaos Report last year, were US banks like JP Morgan Chase, Wells Fargo, Citi and Morgan Stanley. But there are also European banks in the mix, like BNParibas, Barclays, Deutsche Bank and Scotiabank. So, what is going on, given that many of these banks say they support the Paris Agreement and some are members of something called the Net Zero Banking Alliance?

“Insiders say these banks think tighter government regulation will come, so they want to support as much fossil fuel expansion as possible — and make a lot of money — before that happens. They are happy, it seems, to lock the world into more fossil fuel infrastructure in the name of profit, even if that infrastructure leads to more climate change and may soon be stranded — another definition of madness!

We do have choices about where we bank. We can move the money away from the masters of the universe to the fathers and mothers of a better future. The coming 1 to 2 years are going to be potentially a key window in the history of humanity. Governments need to urgently ensure that there is transparency in the area of investment funds so investors can make real choices.

“Perhaps new measures, like the EU’s directive on corporate sustainability reporting will help, but overall, progressive investors in equity funds or people with money in banks, need to stand up and be counted to ensure that their money is working for the future, rather than trapping us in the past with all the chilling consequences for every man, woman and child. It is time to move the money!”

The Takeaway

The power of the internet is now available to each and every one of us who wants to send a message to the banking community — We’re mad as hell and we’re not going to take it any more! With help from the We Don’t Have Time app, we can interrogate thousands of banking and investment companies and know instantaneously which support our climate goals and which do not. Now that we have that power, we have to use it, every one of us, all the time. We can’t allow ourselves to be dazzled by cash-back promises and other rewards programs.

If your bank is not doing what you think it should, cut up its credit and debit cards, close your accounts, and move your money to an institution that will put it to work on lending that meets your climate goals. Do it now if not sooner. The planet you save may be your own.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.

This post has been syndicated from a third-party source. View the original article here.