Globally more is being spent on coal than copper mining

The top seven miners have now upped capital outlays by more than 50% from the depths of the industry downturn in 2017. Govreau sees “no reason why expenditures won’t continue to be elevated for the next several years or more as companies look to increase production to meet expected demand growth from the energy transition.”

Red metal goes green

The decarbonisation revolution is not off to a great start though, not if you compare investments in the worst of the fossil fuels in terms of emissions – coal – with that of copper, without which there simply is no green energy transition.

Copper’s metal intensity – kilograms required per MW produced – of renewable energy sources like solar and wind is nowhere near that of coal or gas. To generate 1MW of offshore wind energy around 8.2 tonnes of copper have to be installed. The same figure for coal is 882kg.

According to one study, in order to reach net-zero by 2050, 19 million tonnes of additional copper need to be delivered. That implies a new La Escondida – the world’s largest copper operation by a wide margin – must be discovered and enter production every year for the next 20 years.

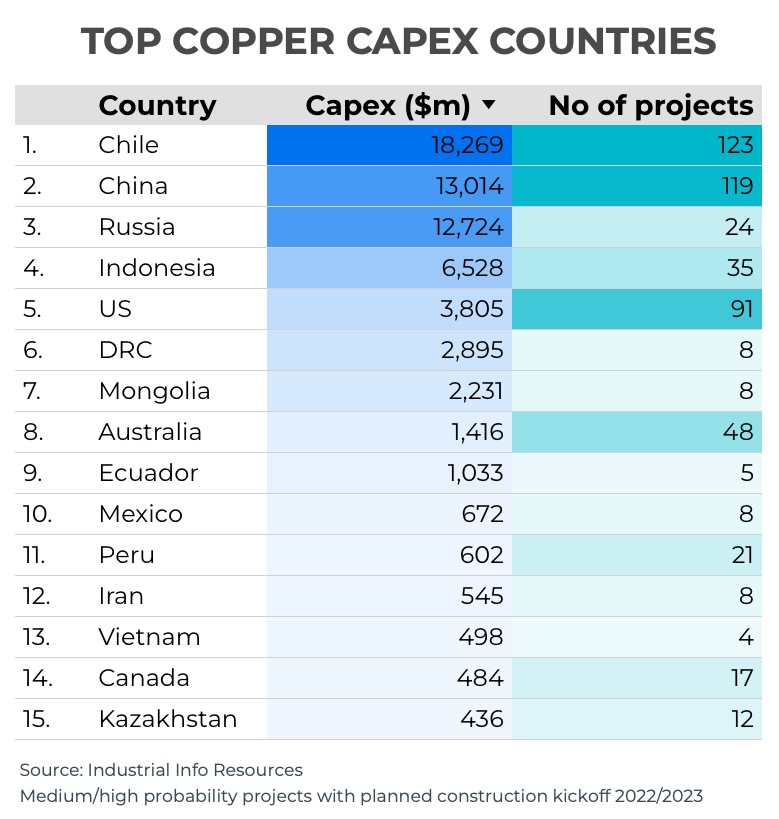

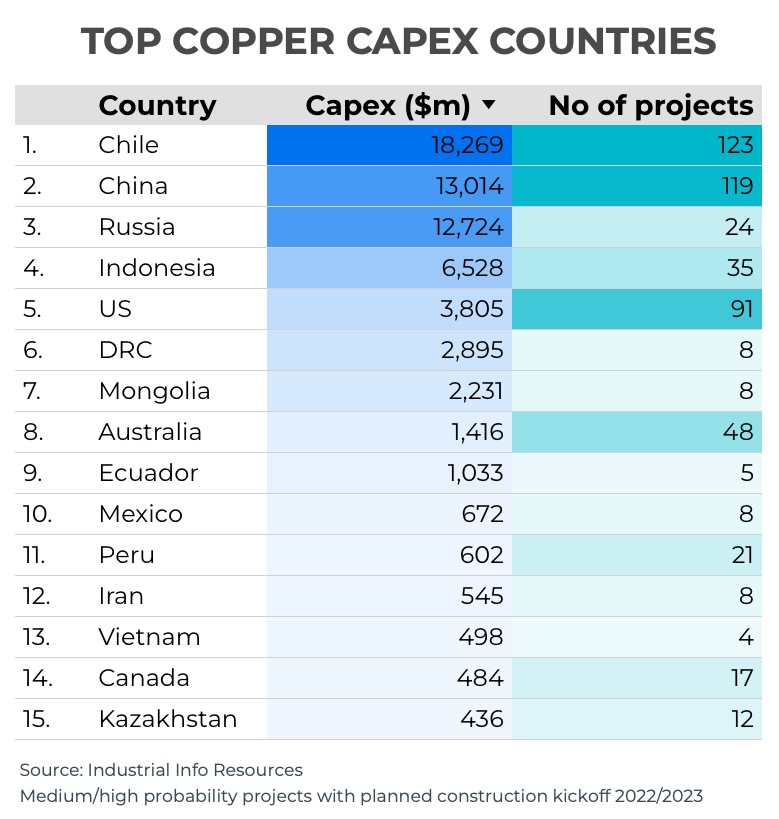

IIR tracks 708 active copper projects with construction kickoff in 2022/2023 around the globe. The combined value of these projects, which includes mining, processing and smelting, is $68.5 billion.

Unsurprisingly, Chile, the world’s largest copper producer and reserves holder, leads the way with 123 projects worth $18.3 billion followed by China boasting 119 projects with a combined value of $13 billion and Russia which is spending $12.7 billion on 24 new copper projects.

In contrast, the US is spending $3.8 billion while Canadian spending on new copper ventures is a paltry $484 million, behind Iran and Vietnam. Govreau also points to Peru, the world’s number two producer, which is spending only $602 million after pandemic lockdowns and social unrest brought development to a standstill.

Back in black

In contrast to copper, coal has a pipeline of 1,863 projects around the globe with a value of $80.8 billion.

Govreau says coal consumption and production jumped over the past year on the back of increased demand for power generation and steelmaking. Consumption of metallurgical coal is expected to be strong again this year.

The Chinese ban on Australian coal is a boost for swing suppliers – US coal exports were up 26% last year, says Govreau. Asian nations are also upping investment in coal mining, and in contrast to Europe and the US, more coal-fired plants are being built than are being retired.

China derives 65% of its electricity from coal, has vast amounts of reserves and is heavily investing in consolidating and automating its coal mines to supply its massive power generation fleet. Coal mining is also attracting investment in the near term because soaring gas prices makes it a cheaper alternative for electricity generation.

This post has been syndicated from a third-party source. View the original article here.