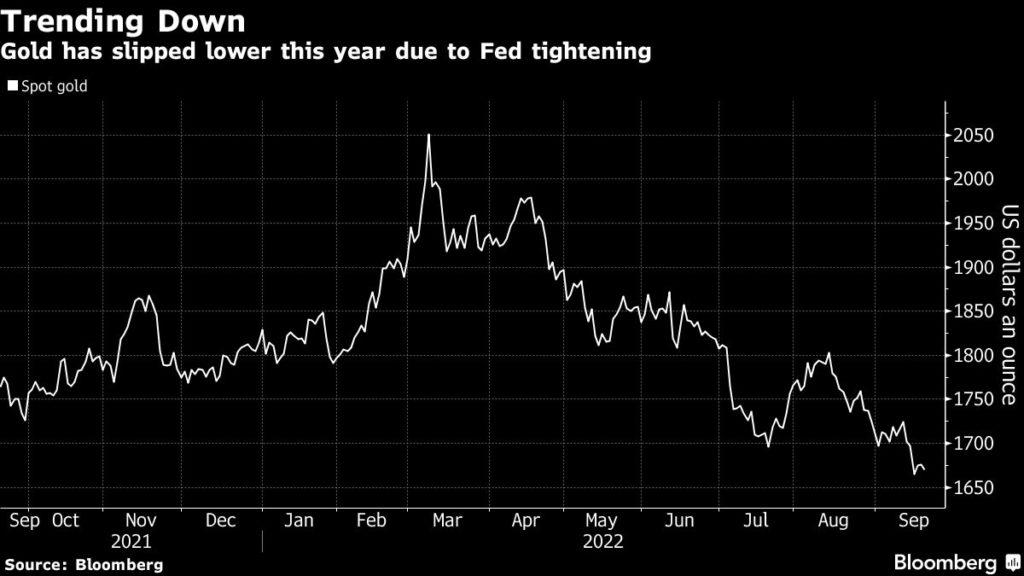

Gold price drops to two-year low with Fed rate hike in focus

[Click here for an interactive chart of gold prices]

Gold’s decline comes on the back of hot inflation data that spurred some bets on a 100 basis point rate hike by the US central bank. Exerting more pressure on bullion is the US dollar, which rose again towards a two-year high. Also rising are inflation-adjusted Treasury yields, which are almost at a 15-year high.

“Gold can’t shake off any of these aggressive Fed tightening concerns… yields continue to skyrocket, especially in the short end of the curve — that’s just been consistently putting pressure on gold,” Edward Moya, senior analyst with OANDA, told Reuters.

Most economists see the Fed opting for a smaller 75 basis point increase, which will have largely been priced in by bullion traders. Other central banks, including the Bank of England will also make rate decisions this week.

Investors are continuing to pare back their gold positions, with exchange-traded fund holdings down to the lowest since January 20. Physical buying from China appears strong, with total imports of non-monetary gold last month jumping to the highest since June 2018, according to data from the country’s customs administration.

“For gold, a further slide to the mid-$1,500 an ounce level is possible,” UBS AG Wealth Management strategists including Wayne Gordon wrote in a Bloomberg note. “With 10-year US real yield expectations breaking above 1% and a stronger US dollar, we see further outflows from ETFs and futures over coming months.”

Longer term, bullion enthusiasts at the annual Denver Gold Forum this week are optimistic. Prices will reach $1,806.10 by year-end, according to the average estimate in a survey of 10 participants at the industry’s biggest annual gathering. The forecast is 7.8% above Monday’s spot closing price, and the last time gold settled that high was at the beginning of July.

(With files from Bloomberg and Reuters)

This post has been syndicated from a third-party source. View the original article here.