Strait of Hormuz is in focus as Israel-Hamas war threatens to spread

It’s been nearly four weeks since Israel declared war on Palestinian militant group Hamas, and as the conflict in Gaza enters the second stage, concerns of a spillover into the wider Middle East region is also mounting.

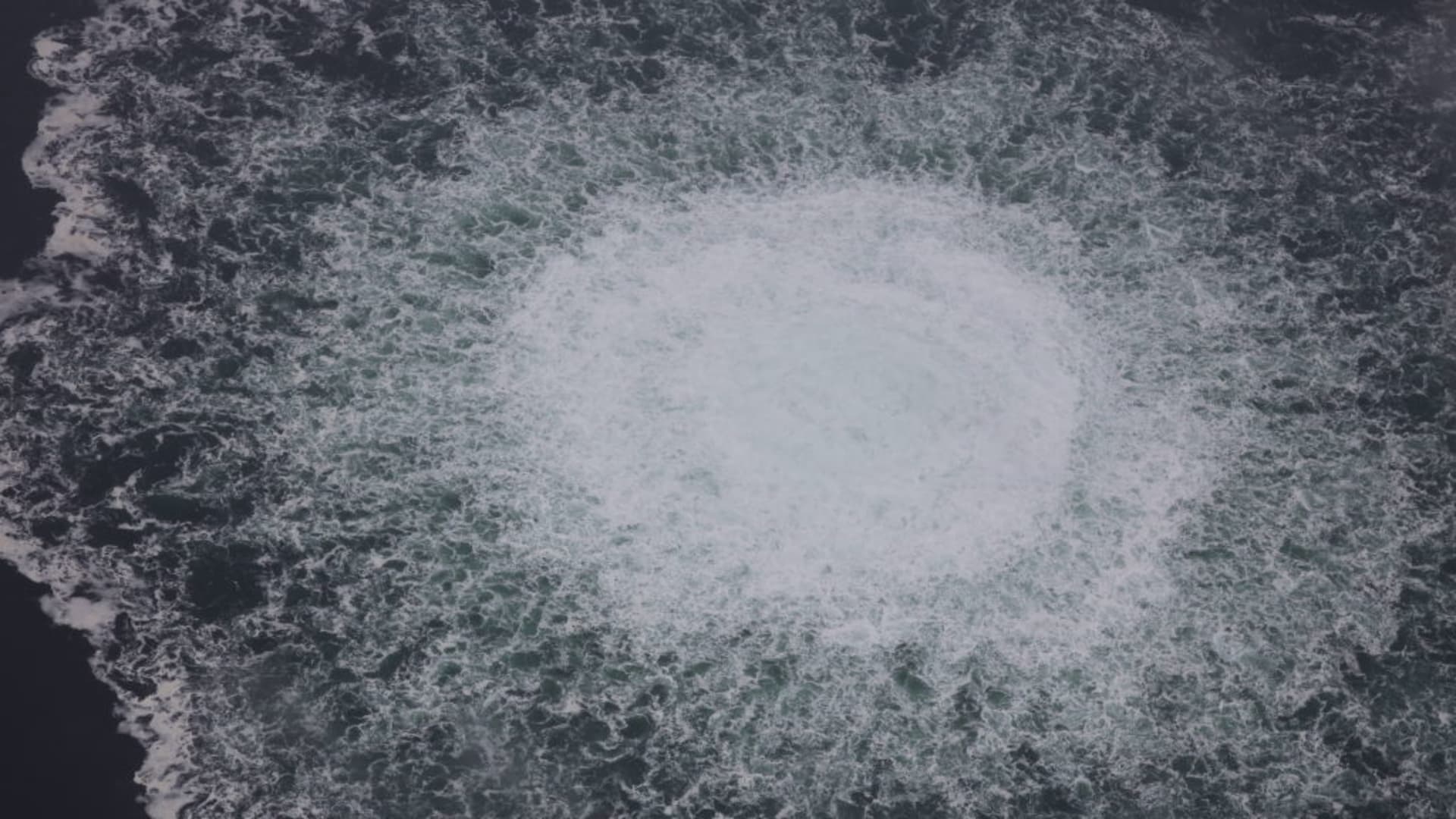

Market observers are keeping a close eye on the the Strait of Hormuz — the world’s most important oil transit chokepoint, to see if there may be any potential impact.

The strait, which sits between Oman and Iran, is a vital channel where about one fifth of global oil production flow daily, according to the Energy Information Administration. It is a strategically important waterway linking crude producers in the Middle East with key markets across the world.

On Oct. 7, Hamas militants launched a multi-pronged attack by land, sea and air and infiltrated Israel, killing more than 1,400 people. In retaliation, Israel launched air strikes and a ground invasion into the Gaza Strip, which has so far killed more than 9,000 people in the enclave.

Risks of it spiraling into a wider conflict remain. The U.S. has deployed military assets to the region to support Israel which is fending off rocket volleys from Iran-backed militants in neighboring Lebanon and Syria.

The U.S. has also carried out airstrikes against targets linked to Iran’s Revolutionary Guard Corps in Syria.

A retaliation from Israel against Iran risks a closure of the strait, pushing oil prices to above $250 a barrel, a recent Bank of America note predicted. Iran is a major oil producer, and its proxies include Hamas and the Hezbollah, militant organizations that are respectively based in Gaza and Lebanon and have stated aims to destroy Israel.

Observers worry that Israel’s intense bombardment of the Gaza Strip will incite more of its adversaries to attack from new fronts, risking a spill over into the wider Middle East region.

However, some industry watchers say that a closure is unlikely.

“The probability of a supply disruption, especially the shutdown of the Strait of Hormuz, is of a low probability,” said Andy Lipow, president of Lipow Oil Associates. He said oil producers like Saudi Arabia, Iran, Iraq and Kuwait are still reliant on the revenue that comes with access to the strait.

Goldman Sachs echoed the same sentiment.

Analysts led by head of oil research Daan Struyven said in an Oct. 26 note that a “severe supply downside scenario” as a result of an interruption of trade through the Strait of Hormuz is not likely to materialize.

On Sunday, Iranian President Ebrahim Raisi said on social media platform X, formerly known as Twitter, that Israel had “crossed the red lines, which may force everyone to take action.”

Foreign ministers of Arab nations — including the United Arab Emirates, Jordan, Bahrain, Qatar, Kuwait, Saudi Arabia, Oman, Egypt and Morocco — condemned the targeting of civilians and violations of international law in Gaza by Israeli forces. Israel says it does not target civilians, only terrorist targets.

In 2019, Iran repeatedly threatened to disrupt oil shipments going through the Strait of Hormuz after former U.S. President Donald Trump withdrew from the landmark 2015 nuclear deal and restore sanctions on the Islamic country. In the past two years alone, Iran has attacked or interfered with 15 internationally flagged merchant vessels, according to data from the U.S. Navy.

On Monday, the World Bank projected that oil prices could surge to $157 per barrel should the ongoing conflict continues to escalate.

The World Bank warned of a repeat of the Arab oil embargo in 1973, where Arab energy ministers imposed an embargo on oil exports on the U.S. in retaliation for its support of Israel in the 1973 Arab-Israeli war.

In such a scenario, there could be a “large disruption” scenario, “that would drive prices up by 56% to 75% initially — to between $140 and $157 a barrel,” the report said.

Lipow said it’s not likely for such a scenario to take place.

“Times are quite different today than they were 50 years ago, because you have these Mideast countries that simply need the [oil] revenue,” he said.

That said, Lipow pointed out that Iran has been “prosecuting the war through its proxies.”

“One of my fears is that maybe one of these proxies makes a very bad mistake when they’re attacking Israel,” he added. Should that happen, the analyst said Israel will likely retaliate, going “right for Iran’s jugular” which would deteriorate very quickly into a regional conflict.

This post has been syndicated from a third-party source. View the original article here.